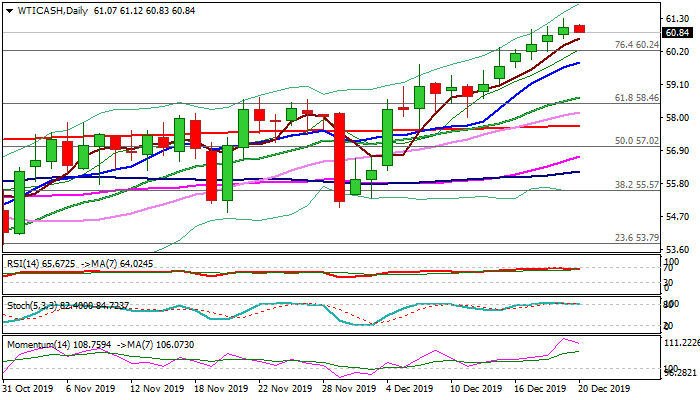

Overbought conditions suggest consolidation before bulls resume

WTI oil price remains steady and consolidating under new three-month high at $61.33, being boosted by drop in US crude stocks and easing trade tensions that brighten the outlook for global economic growth and energy demand.

Strong advance in past three weeks (up near 10%) and today’s close above weekly cloud top add to positive signals, but week-end profit-taking may push the price lower.

Overbought daily stochastic and fading bullish momentum add to negative signals.

Corrective dips are expected to provide better opportunities for re-entering bullish market, with extended dips to find ground above psychological $60.00 support, reinforced by rising 10DMA ($59.85) to keep bulls intact.

Res: 61.12; 61.33; 62.00; 62.35

Sup: 60.64; 60.24; 60.00; 59.85