PM Johnson’s final Brexit offer to EU is key event on Wednesday

Cable stands at the back foot in early Wednesday’s trading, following Tuesday’s roller-coaster action when the pair cracked daily cloud base (1.2224) and hit new one-month low (1.2204), but subsequently bounced to 1.2337 (session high) on downbeat US Manufacturing PMI data which smashed dollar.

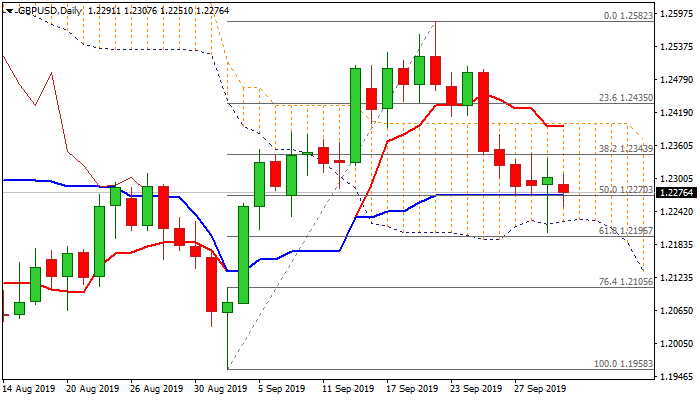

Tuesday’s strong rejection at key support and daily action ending in long-tailed Doji candle, signaled strong indecision, as bears failed to close below 1.2270 pivot (daily Kijun-sen / 50% retracement of 1.1958/1.2582) for the third consecutive day.

Overall picture remains negative, but bears so far lacked strength to extend lower and awaiting signals from today’s key event – speech of UK PM Boris Johnson.

Johnson will unveil his final Brexit offer to the EU and expected to make clear that if the Union does not accept his proposal, the Britain will stop negotiations and will leave EU on 31 October.

The final plan will offer special relationship between Northern Ireland and the EU until 2025, after which they will decide whether they want to stay in the union or return to British jurisdiction.

Increased volatility is expected on announcement of the plan, with reaction of the EU to have strong impact on pound.

Strong bearish signal could be expected on firm break of daily cloud base and nearby Fibo support at 1.2196 (61.8% of 1.1958/1.2582) that would expose next pivotal support at 1.2105 (Fibo 76.4%) and unmask key 1.20 support zone on break here.

Daily 30MA marks initial resistance (1.2319) but sustained break above 1.2343 (broken Fibo 38.2% of 1.1958/1.2582) is needed to generate initial reversal signal, which would require confirmation on extension and break above daily cloud top (1.2399).

Res: 1.2307; 1.2319; 1.2343; 1.2380

Sup: 1.2251; 1.2204; 1.2196; 1.2105