Probe through 1.1700 opens way towards key Fibo barrier at 1.1780

The Euro cracked psychological 1.17 barrier on Friday, in extension of previous day’s strong rally.

The single currency was up 0.56% on Thursday, after the ECB kept rates unchanged, staying on track to end the QE this year and raise interest rates in the second half of 2019.

Main support to Euro came from weaker dollar, hit by downbeat US CPI data and signs of reduced trade tensions between the US and China.

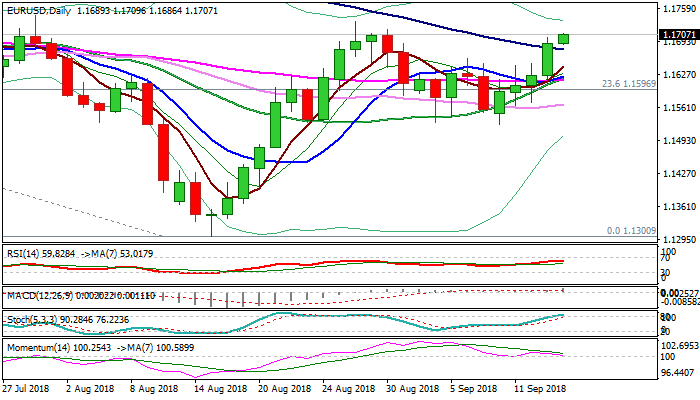

Thursday’s close above falling 100SMA was bullish signal for final push towards 28 Aug high at 1.1733 and possible extension towards key Fibo barrier at 1.1780 (38.2% of 1.2555/1.1300 fall).

Bulls so far ignore weakening momentum and overbought slow stochastic on daily chart, which suggests consolidative / corrective action in the near-term.

Broken 100SMA should ideally hold, but deeper dips cannot be ruled out, with 1.1650 zone (former multiple upside rejections / broken Fibo 61.8% of 1.1733/1.1526 descend) expected to contain and keep bullish bias.

EU trade balance data is the key event of the European session, with US retail sales, due later today, eyed for further signals.

The Euro is on track for strong weekly bullish close which reinforces bullish stance for further upside, with break through 1.1780 pivot needed to spark fresh acceleration higher.

Res: 1.1718; 1.1733; 1.1750; 1.1780

Sup: 1.1677; 1.1650; 1.1616; 1.1566