Profit taking and weaker sentiment fuel gold’s sharp pullback

Gold price falls over 2% on Monday, as traders collect profits from last week’s almost 6% rally (the biggest weekly gain in nearly two years).

Weaker sentiment on easing safe-haven demand following the nomination of Scot Bessent as the next US Treasury Secretary, who is seen as less hawkish and could positively influence Trump administration’s plans to impose severe tariffs on imports into US and avoid trade war (China is targeted primarily but the Eurozone is very likely to be hit).

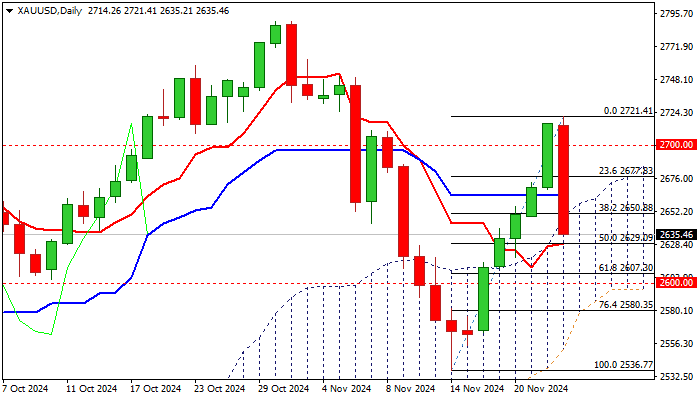

Technical picture on daily chart shows that recovery rally from recent correction low at $2536 (Nov 14) is likely over, as 14-d momentum remains in negative territory and turned south and stochastic is reversing from overbought territory.

Fresh weakness cracked significant supports at $2650/48 (Fibo 38.2% of $2536/$2721, reinforced by 55DMA and the top of rising daily Ichimoku cloud) with daily close below these levels to validate negative signal and focus net targets at $2629 (50% retracement) and $2621 (10DMA), guarding $2607/00 (Fibo 61.8% / psychological).

Daily cloud top / broken Fibo, reverted to initial resistances ($2648/50), followed by daily Kijun-sen ($2663) which should cap upticks and keep bears in play.

Res: 2650; 2663; 2668; 2677

Sup: 2629; 2621; 2607; 2600