Pullback extends on fresh risk appetite / bull-trap

The pair accelerates lower in early Tuesday’s trading, holding in red for the third straight day and warning of deeper fall, as rising risk appetite on bitcoin surge weighs on dollar.

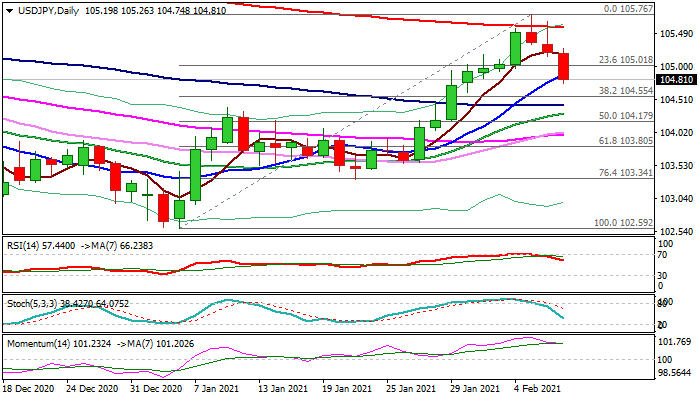

Fresh bears emerged after recovery rally from 102.59 (Jan 6 low) stalled on attempts to clear 200DMA (105.60), forming a bull-trap pattern on daily chart, with long upper shadows on candles of past two days signaling strong offers.

Probe below 105.00 round-figure support and nearby rising 10DMA (104.88) triggered initial stops which could fuel further weakness for test of key Fibo support at 104.55 (38.2% of 102.59/105.76), loss of which would expose next pivotal supports at 104.42/30 (100DMA / 20DMA) and 104.17/13 (50% retracement / daily cloud top).

Daily studies support the action as RSI and Stochastic are heading south after reversing from overbought zone and bullish momentum is weakening.

Bears are expected to face headwinds from strong technical supports at 104.50 zone and a number of stops parked below.

Res: 105.00; 105.26; 105.58; 105.76

Sup: 104.74; 104.55; 104.42; 104.30