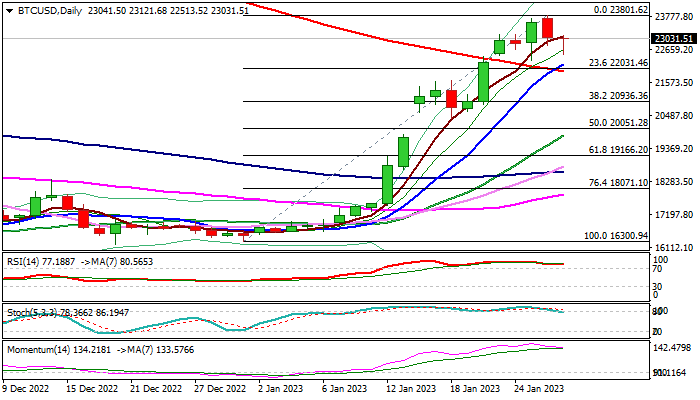

Pullback finds footstep above significant support

Bitcoin managed to stabilize after Thursday’s 2.7% pullback extended on Friday but find ground above strong support at 22187 (rising 10DMA), which also created a golden-cross with 200DMA and additionally underpin the action.

Dip should be ideally contained at this zone to keep intact larger bulls, fueled by expectations that Fed rates would peak around 5% in mid-2023.

Limited correction would keep immediate focus at the upside for extension towards strong barriers at 27951/29249 (Fibo 38.2% of 48197/15437 bear-leg / base of falling thick weekly cloud), with formation of bullish reversal pattern on monthly chart, supporting the notion.

However, caution is required despite today’s spike lower and subsequent strong rebound as daily studies are overbought and strong bullish momentum is weakening that keeps in play risk of deeper pullback.

Break and close below 10DMA (22187) and 200DMA (21945) is needed to activate scenario and open way for extension towards next significant support at 20936/20847 (Fibo 38.2% of 16300/23801 / Jan 20 low).

Res: 23160; 23696; 23801; 24649

Sup: 22513; 22187; 21945; 21610