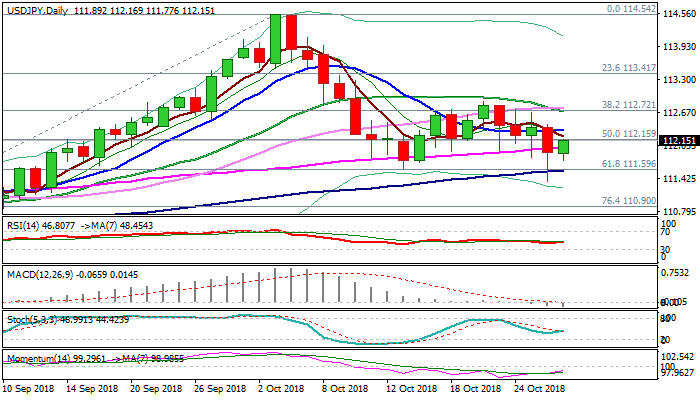

Recovery after strong downside rejection probes above 55SMA pivot

The pair probes above 112 handle on Monday, following strong downside rejection on Friday and failure to take out cracked key supports – daily cloud; Fibo 61.8% of 109.77/114.54; rising 100SMA.

Friday’s long-tailed candle is initial signal bears’ stall, with strengthening momentum on daily chart, supporting recovery attempts.

Fresh strength needs close above 55SMA (112.01) to generate fresh bullish signal, with extension through 10SMA (112.34) to confirm scenario.

On the other side, bearishly aligned daily techs keep the downside in focus for renewed attempt at key 111.60 support zone,

Eventual break here and close below daily cloud base (111.47) would generated strong bearish signal for extension of pullback from 114.54 (04 Oct low).

Res: 112.34; 112.52; 112.76; 112.88

Sup: 110.77; 110.60; 110.47; 110.00