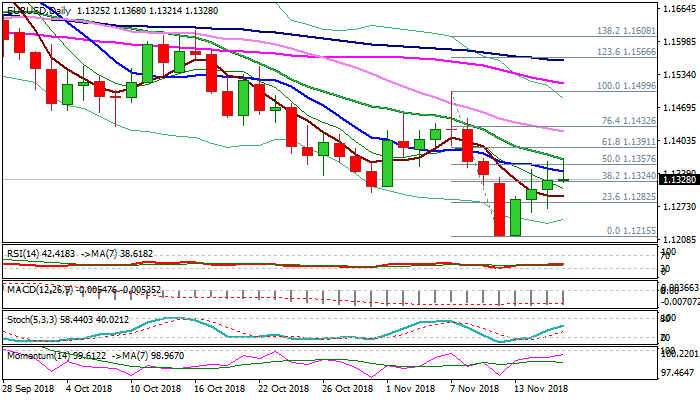

Recovery attempts struggle at pivotal 1.1342/67 resistance zone

The Euro stands at the front foot on Friday, but upside attempts show strong hesitation at pivotal Fibo barrier at 1.1357 (50% of 1.1499/1.1215 bear-leg), as probe above 1.1357 repeatedly failed and was capped by falling 20SMA.

Near-term structure would weaken if the action ends week below pivotal resistance zone between 1.1342 and 1.1367 (falling 10SMA / Fibo 50% / falling 20SMA), with return below 1.1310 (cracked 200WMA) to confirm negative stance.

Bullish scenario requires close above 20SMA to open way for 1.14+ gains.

EU CPI came in line with expectations in Oct, with performance of British pound expected to affect the single currency.

Res: 1.1342; 1.1357; 1.1367; 1.1391

Sup: 1.1321; 1.1292; 1.1263; 1.1215