Recovery rally risks stall at key barriers

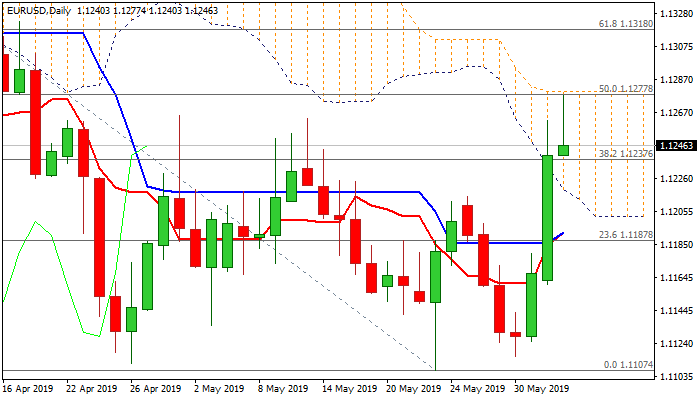

The Euro extends advance of past two days (Monday’s 0.69% rally marks the biggest one-day gain since 25 Jan) to test key barriers at 1.1277/79 (50% retracement of 1.1448/1.1107 / 100SMA / daily cloud top) in early Tuesday’s trading.

Improved sentiment on weaker dollar fuels Euro’s recovery, which is also helped by strong bullish momentum, but bulls show hesitation.

Overall trend is still bearish and risk of recovery stall exists as three-day recovery may offer better selling opportunity on rejection at key barriers.

Return and close below 1.1220/15 (broken 55SMA / former high of 27 May / Fibo 38.2% of 1.1111/1.1277 recovery leg) would generate bearish signal, which will be confirmed on extension below a cluster of converged daily MA’s at 1.1185/80.

Firm break above 100SMA / daily cloud top, on the other side, will generate bullish signal for extension of recovery phase towards 1.1318/23 (Fibo 61.8% of 1.1448/1.1107 / mid-Apr lower platform).

Res: 1.1277; 1.1323; 1.1367; 1.1375

Sup: 1.1237; 1.1215; 1.1180; 1.1160