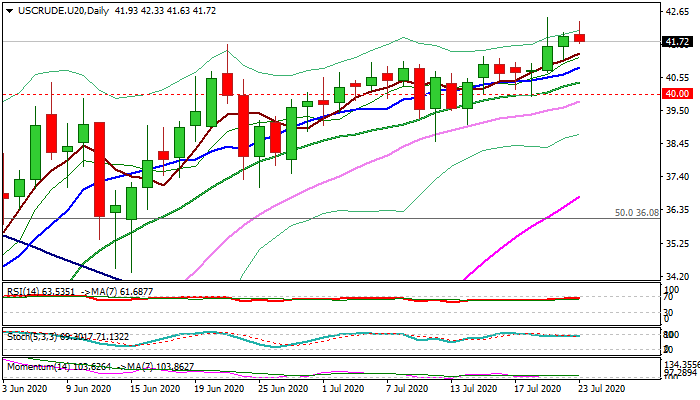

Recovery shows signs of fatigue on approach to key barriers at $43.05/42

WTI oil dipped below $42 in mid-European trading on Thursday after attempt to retest Tuesday’s $42.48 high (the highest in nearly five months) run out of steam.

Oil maintains firm bullish tone, driven by falling dollar and hopes that demand recovery would regain pace.

On the other side, unexpected rise in US crude inventories and news that Saudi Arabia’s oil exports dropped by 65% in May, weigh and may slow bulls on approach to strong barriers at $43.05 (200DMA) and $43.42 (Fibo 61.8% retracement of $65.63/$6.52 fall).

The WTI contract is on track for monthly close above psychological $40 level that would add to positive signals, however, close above $43.05/42 pivots is needed to signal recovery extension.

On the other side, persisting concerns about global demand recovery and fragile political situation over US/China tensions, may limit recovery.

Res: 42.33; 42.48; 43.05; 43.42

Sup: 41.61; 41.18; 40.40; 40.00