Relaxing China’s Covid restrictions and supply concerns keep the oil price supported

WTI oil price rose on Wednesday and pressure Tuesday’s peak at $115.52 (the highest since Mar 24), extending bull-leg off $98.17 (May 11 higher low.

Oil price fresh support from easing of Covid restrictions in China, drop in Russian oil production in April that raised supply concerns and fall US crude and gasoline stocks (API report).

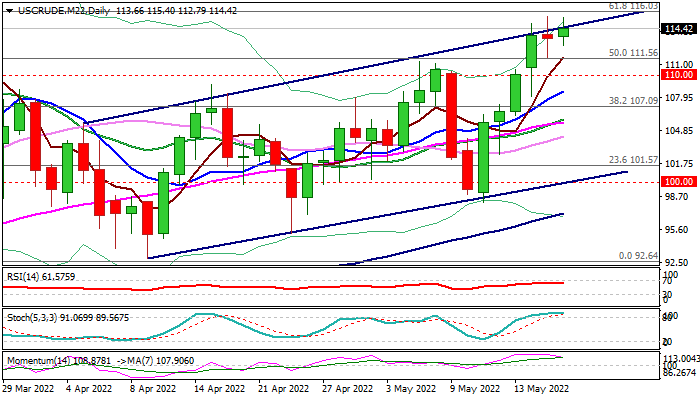

Fresh strength attempts to clearly break through cracked trendline resistance at $114.73 (upper boundary line of bull-channel from Apr 11 low at $92.92), that would signal further bullish extension towards $116.03/60 (Fibo 61.8% of $130.48/$92.64 / Mar 24 high).

While fundamentals remain supportive, technical studies on daily chart are mixed, with MA’s being in bullish configuration, but stochastic strongly overbought and fading bullish momentum.

This warns that bulls might be running out of steam and would continue to struggle at pivotal trendline resistance.

Overall structure, however, remains positive and bias is expected to stay with bulls while the price action holds above broken psychological $110 level, now reverted to solid support.

Traders focus the US EIA crude inventories report, which shows forecast for crude stocks to drop to 1.38 million barrels from 8.48 million barrels previous week.

Res: 115.52; 116.03; 116.60; 117.12

Sup: 112.79; 111.56; 110.00; 108.49