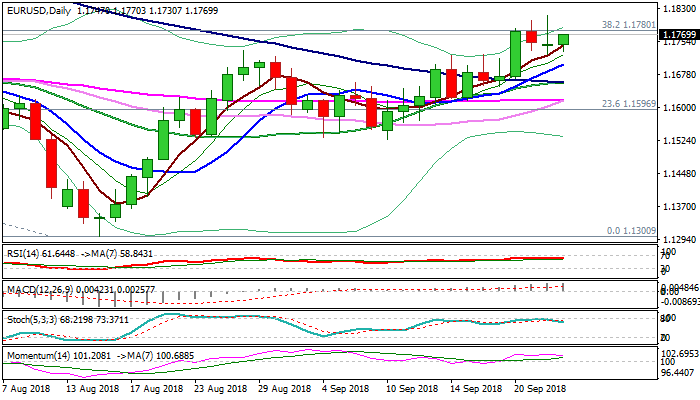

Repeated failure to clear 1.1780/1.1800 pivots keeps risk of pullback in play

The Euro holds within narrow range in early Tuesday’s trading, following another upside rejection at 1.1800 zone on Tuesday, after the pair was boosted by hawkish comments from ECB’s chief Draghi regarding inflation, but initial optimism was deflated after Draghi repeated that interest rates would remain at current levels until the third quarter of 2019.

Tuesday’s Doji with long upper shadow could be a negative signal, as bulls repeatedly failed to clear 1.18 barrier and also failed to close above 1.1780 (Fibo 38.2% of 1.2555/1.1300) , with weakening momentum and south-turning slow stochastic, after forming bearish divergence, weighing on near-term action.

Bearish scenario requires confirmation on close below 1.1700 support (rising 10SMA / Fibo 38.2% of 1.1526/1.1815 upleg) to open way for deeper pullback.

Bullish bias is expected to remain intact while the price holds above 1.1724 (Tuesday’s low) with renewed attempts at 1.18 zone to be anticipated, but stronger action could be expected after Fed announces its decision on Wednesday.

Res: 1.1800; 1.1815; 1.1848; 1.1900

Sup: 1.1724; 1.1700; 1.1670; 1.1659