Reversal pattern is forming on weekly chart and oil prices can fall more on easing geopolitical tensions and improving supply outlook

WTI oil extends pullback from new 7-year high and holding comfortably below psychological $90 level, on track for the first bearish weekly close (down over 6% for the week) after rallying for eight consecutive weeks.

From the fundamental side, two key factors influenced current price drop: easing in geopolitical tensions over Ukraine, with growing hopes for a peaceful solution as diplomacy worked hard these days and prospects of increased exports from Iran, as OPEC+ group works in re-integrating Iran into its oil supply deal that would bring back 1.3 million barrels of Iran oil to the market and ease strong fears about global supply shortage.

Current improved conditions prompted traders to take profits after oil’s strong rally in past 2 ½ months, pushing the price lower.

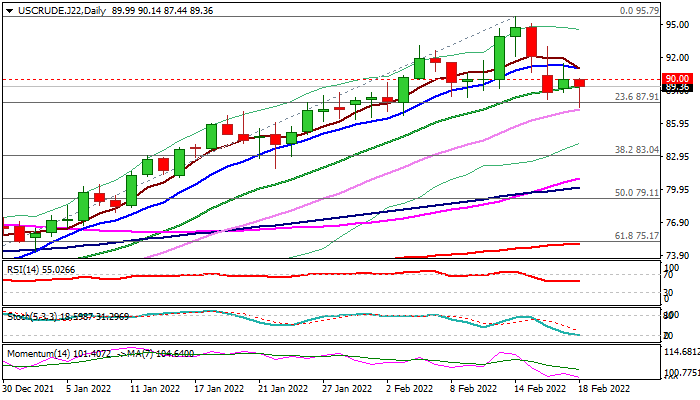

Technical studies on daily chart already weakened, as south-heading 14-d momentum is about to break into negative territory, signaling that larger rally has lost traction and deeper correction should follow.

Weekly studies are generating initial bearish signals, as reversal pattern is forming on weekly chart, with RSI and stochastic reversing from overbought zone and bullish momentum is fading, adding to expectations that oil prices could ease further.

Fresh bears cracked initial Fibo support at $87.91 (23.6% retracement of $62.42/$95.79 rally), with close below here to open way towards key supports at $83.04/$82.77 (Fibo 38.2% / rising 10WMA) break of which is needed to confirm reversal and open way for dips below $80 level.

Broken $90 level and 10DMA ($90.82) reverted to resistances, which should cap and keep fresh bears in play.

Fundamentals, however, remain key factors influencing oil’s performance and any escalation of the crisis over Ukraine would inflate the oil prices again.

Res: 90.00; 90.82; 93.04; 94.56

Sup: 87.29; 84.15; 83.04; 80.95