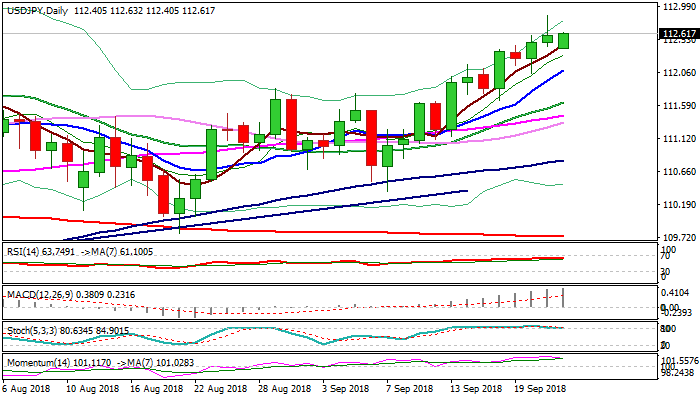

Risk of deeper pullback exists but bulls will remain intact while 112.40 support holds

The pair consolidates above session low at 112.40, posted after Monday’s gap-lower opening, as China cancelled trade talks with the US.

Strong upside rejection on Friday (112.87) could be initial signal of pullback, with scenario being supported by slow stochastic attempting to reverse from overbought zone and momentum turning south and attempting to form bear-cross.

Today’s twist of daily cloud could also attract bears, but the action requires initial signal on break below 112.00 support zone (rising 10SMA / Fibo 38.2% of 110.38/112.87 upleg).

Conversely, overall bullish tone is expected to remain intact while the price holds above initial supports at 112.40/45 (session low / rising 5SMA) for renewed attempt at 112.87 (Fiday’s high) and key barrier at 113.17 (19 July peak) in extension.

Res: 112.63; 112.87; 113.17; 113.30

Sup: 112.40; 112.09; 111.92; 111.63