Risk of recovery stall would increase on failure to clearly break above daily cloud

The Euro continues to benefit from weaker dollar, pressured by fall of US stocks which had the worst performance in almost eight months.

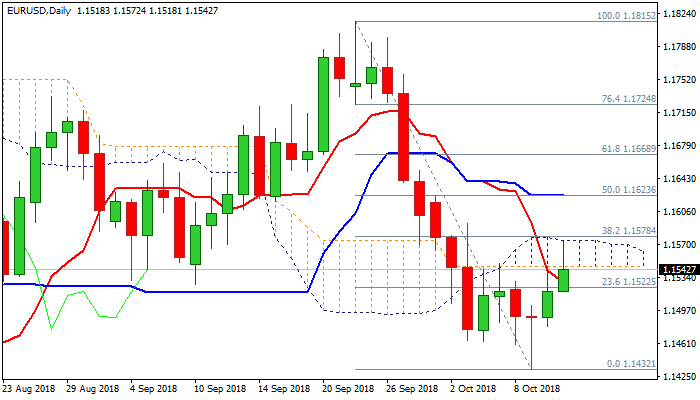

Extension of recovery from Tuesday’s spike low at 1.1432 penetrated daily cloud and dented cloud top (1.1572), but without break higher so far.

Key barriers lay at 1.1572 (cloud top) and 1.1578 (Fibo 38.2% of 1.1815/1.1432 fall) and sustained break here is needed to complete reversal pattern on daily chart and signal stronger recovery towards 55SMA (1.1590) and converged 20/30SMA’s (1.1616).

Break above 10SMA (1.1526), north-heading slow stochastic and momentum turning up, are supportive factors, with Tuesday’s long-tailed Doji, which signaled strong downside rejection, underpinning the action.

However, fresh bulls are for now lacking strength for final break higher, which could be seen as initial warning of recovery stall and supporting selling upticks scenario, as concerns over Italian budget persist and keep the single currency under pressure

Repeated close below daily cloud base would add to negative outlook and keep near-term risk skewed lower.

Res: 1.1572; 1.1578; 1.1590; 1.1616

Sup: 1.1526; 1.1512; 1.1480; 1.1463