Silver drops below $20 for the first time in two years as recession fears hurt demand

Spot silver broke through psychological $20 support for the first time in two years and hit the lowest since July 2020 on Friday.

The metal remains under increased pressure for three months on global economic and geopolitical turmoil which threatens of further deterioration that could push many economies into recession, denting metal’s strong industrial exposure.

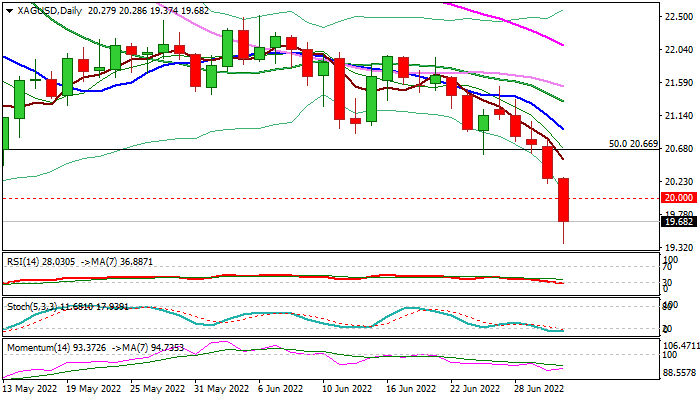

Bearish techs on daily chart add to negative signals generated on break through pivotal supports at: $20.66 (50% retracement of $11.23/$30.10); 20.42 (200WMA) and psychological $20 level, though weekly close below $20 is needed to confirm and open way for extension towards target at $18.44 (Fibo 61.8%).

Silver is also on track for the fifth straight weekly drop, with this week’s fall being the biggest since the third week of June 2021 and large bearish weekly candle is expected to heavily weigh on the action in coming sessions.

Caution on oversold conditions on daily chart which signal possible price adjustment, with upticks to offer better opportunities to re-join bearish market.

Res: 20.00; 20.42; 20.66; 20.93

Sup: 19.37; 19.00; 18.44; 17.75