Softer tone and high volatility at the beginning of key week for Brexit

Sterling holds soft tone in early Monday’s trading, at the beginning of key week for Brexit.

Britain’s parliament is going to vote on government’s next steps after PM May’s plan has been repeatedly rejected.

May managed to get short extension of Brexit from the EU last week, but situation remains dramatical as the bloc grants delay until 22 May only if the Britain offers workable and approved plan.

Otherwise, the due date is on 12 Apr until when UK government needs to either offer new plan or exit the EU without deal.

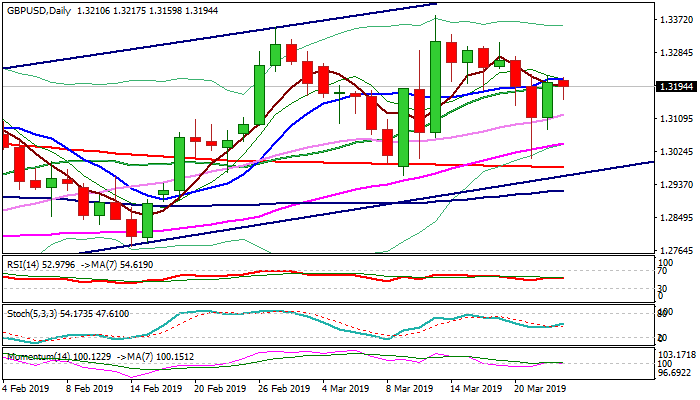

British pound in choppy and volatile mode, as last week’s fall was followed by strong downside rejection above key 200SMA, but ended week in red and below thickening weekly cloud which heavily weighs.

Daily studies are mixed as weakening momentum conflicts rising stochastic while MA’s remain in mixed configuration.

Bullish signal could be expected on sustained break above 1.3225 highs (reinforced by 10SMA) and 1.3237 (Fibo 61.8% of 1.3381/1.3004 that would shift near-term focus higher.

Conversely, dip below rising 30SMA (1.3120) would weaken near-term structure and risk retest of 200SMA (1.2982).

Res: 1.3225; 1.3237; 1.3272; 1.3292

Sup: 1.3159; 1.3120; 1.3080; 1.3045