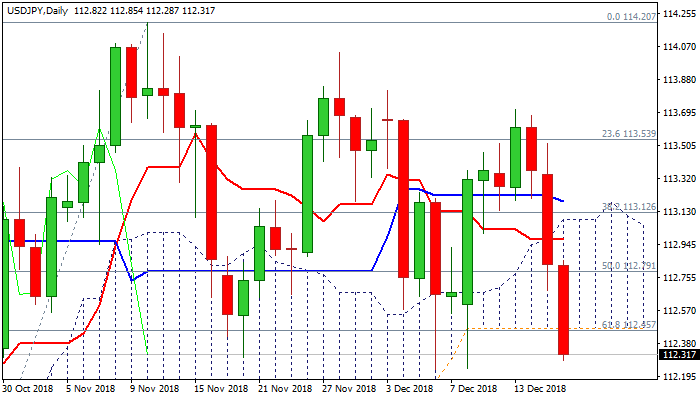

Steep fall accelerates on expectations of dovish Fed and pressures key supports at 112.23/04

The pair extends steep fall from 113.70 high (13 Dec) into third straight day broke below daily cloud which was penetrated on Monday.

Break of strong support at 112.46 (daily cloud base / Fibo 61.8% of 111.37/114.20 rally) opened key near-term support at 112.23 (6/10 Dec double-bottom, also Fibo 23.6% of larger 104.63/144.54 rally) and 112.04 (Fibo 76.4% of 111.37/114.20 bull-leg).

Sustained break here would generate strong bearish signal and risk extension towards 111.37 (26 Oct spike low) and pivot at 110.76 (Fibo 38.2% of 104.63/114.54) in extension.

Bearish sentiment is boosted by risk-off mode and expectations of dovish Fed on Wednesday, which could further weaken the dollar.

Daily studies in strong bearish setup add to negative scenario.

Res: 112.46; 112.85; 113.08; 113.20

Sup: 112.23; 111.77; 111.37; 110.76