Sterling maintains bullish bias after Brexit news improved sentiment

Cable holds firm tone in early Thursday’s trading after previous day’s strong rally on breakthrough from Brexit talks.

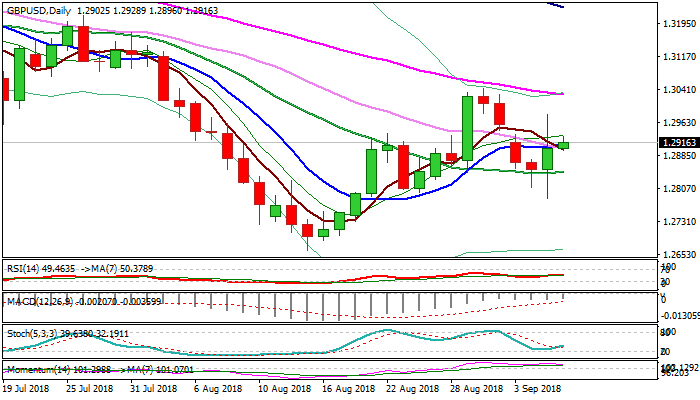

The pair spiked to 1.2983 on Wednesday but was unable to hold gains and pulled back to 1.2900 zone, where it closed for the day.

Long shadows of Wednesday’s daily candle suggest that indecision exists, however, improved sentiment on the latest news regarding Brexit and bullishly aligned daily techs, keep near-term focus at the upside.

Fresh bulls need to fill Monday’s gap to confirm reversal and open way for test of 1.3000 (psychological barrier) and 1.3028/43 (falling 55SMA / 30 Aug high) in extension.

Converged 10/30SMA’s at 1.2900 zone need hold and keep bullish bias.

Conversely, break and close below 20SMA (1.2849) would generate bearish signal.

Res: 1.2933; 1.2983; 1.3000; 1.3035

Sup: 1.2900; 1.2840; 1.2800; 1.2785