Strong corrective rebound comes after six straight days in red

The pair bounced strongly on Friday (up 1.5% for the day so far) after bears faced headwinds and were rejected at 104 zone.

Oversold studies and month-end profit-taking contributed to fresh rally (the pair is heading for the first bullish daily close after six straight days in red.

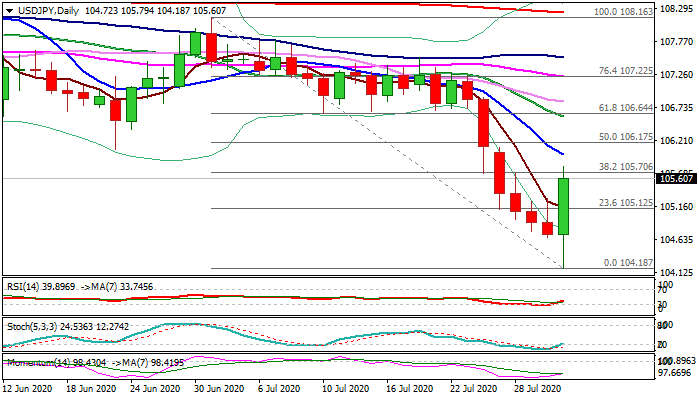

Fresh advance cracked the lower boundary of pivotal barriers at 105.70/105.98 zone (Fibo 38.2% of 108.16/104.18 / falling 10DMA), close above which is required to generate stronger reversal signal and allow for further recovery.

Daily stochastic and RSI head north after emerging from oversold territory and underpin recovery, however, larger picture remains bearish and current action seen as positioning for fresh push lower.

Only break and close above 106.60 (Fibo 61.8% / falling 20DMA) would neutralize bears.

Res: 105.80; 105.98; 106.35; 106.60

Sup: 105.50; 105.13; 104.68; 104.18