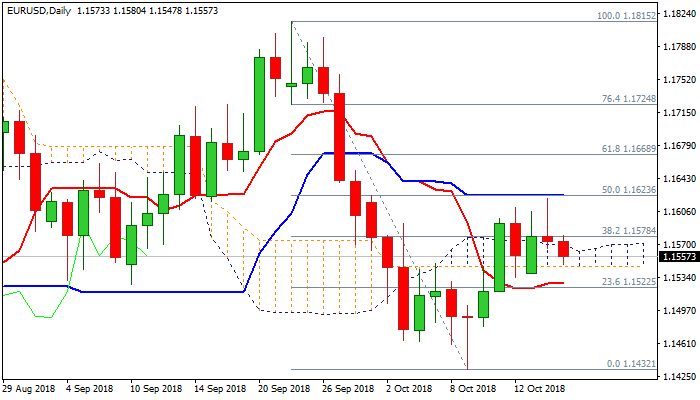

Strong upside rejection risks deeper fall; daily cloud base is key

The Euro stands at the back foot in early Wednesday’s trading and holds within daily cloud after spike to 1.1547 (Asian session low) already tested cloud base.

Tuesday’s daily candle with long upper shadow showed strong upside rejection and could signal top formation as upside attempts on last Fri/Mon were also rejected.

Mixed daily techs provide no clear direction signals, but near-term bias is turning negative.

Bearish signal could be expected on close below daily cloud base (1.1545) which would confirm top and turn focus lower.

On the other side, bullish signal could be expected on sustained break through a cluster of daily MA’s and close above 1.1624 (50% of 1.1815/1.1432 / 100SMA).

Weak German ZEW data on Tuesday added to negative tone, with EU CPI data (Sep m/m 0.5% f/c vs 0.2% prev) and FOMC minutes expected to provide fresh signals.

Res: 1.1569; 1.1580; 1.1600; 1.1624

Sup: 1.1545; 1.1539; 1.1518; 1.1480