The dollar remains at the back foot after less hawkish than expected Fed minutes

The dollar was deflated in European trading on Thursday and entered the US session in red after traders digested Fed’s minutes of January policy meeting and judged that the central bank’s outlook was less hawkish than expected.

Although the policymakers pointed to the start of post-pandemic tightening cycle, as early as March, there was no consensus about the pace of hiking, as hawks look for initial hike of 0.5% (instead of widely expected 0.25%) and continuation of raising rates on coming meetings, others suggest more cautious approach, with initial hike of 0.25% and reviewing the overall situation in the US economy, as well as inflation rate, ahead of each future policy meeting.

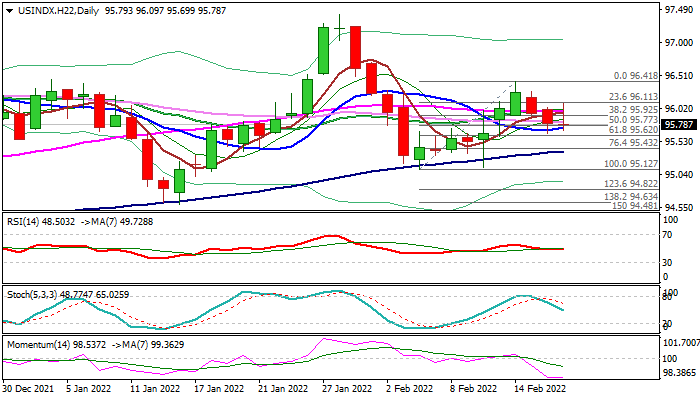

The near-term action pressures pivotal support provided by 10DMA (95.73), also near 50% retracement of 95.12/96.41 upleg, with clear break here to further weaken the structure and risk retest of a higher base at 95.12.

Daily MA’s are still mixed, but bearish momentum remains very strong, adding to weaker post-Fed sentiment.

Daily Kijun-sen (96.00) needs to cap the action and keep near-term bears in play.

Res: 96.00; 96.10; 96.27; 96.41

Sup: 95.65; 95.38; 95.12; 94.87