The Euro bounces on fresh risk mode, underpinned by thick daily cloud

The Euro rebounds in Tuesday’s afternoon trading after sharp fall in Europe, as fresh risk mode prompted traders to collect profits from safe havens, bought earlier today.

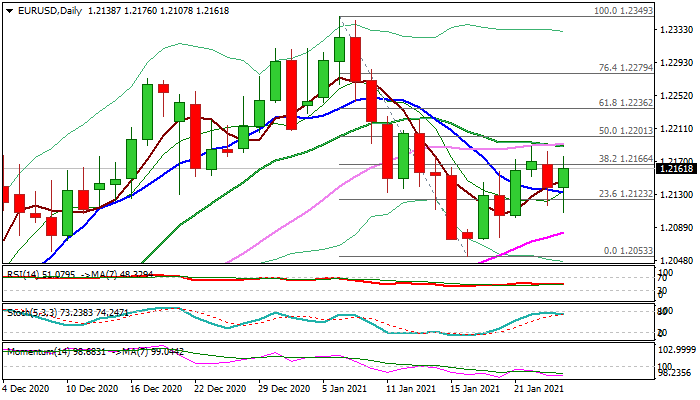

Dips also faced strong headwinds on approach to top of thick rising daily cloud (1.2090), leaving the second long-tailed daily candle, which signals growing bids.

Monday’s dip managed to close above 10DMA (1.2132) and the pair is on track to register another one today that would add to initial positive signals.

Fresh recovery attempts need to register close above 1.2166 (Fibo 38.2% of 1.2349/1.2053 pullback) and rise above 1.2191 (converged 20/30DM’s) to confirm reversal and open way for further recovery.

Janet Yellen became the first woman to lead US Treasury, following vote in the US Senate, which added to risk sentiment, with focus turning on Fed meeting on Wednesday.

The central bank is expected to keep current policy unchanged, but signaled slight optimism about inflation recovery during this year.

Daily studies are still mixed and lack clearer direction signal, with prolonged sideways mode expected while the price stays between 10 and 20/30 DMA’s.

Res: 1.2183; 1.2191; 1.2201; 1.2236

Sup: 1.2132; 1.2107; 1.2082; 1.2076