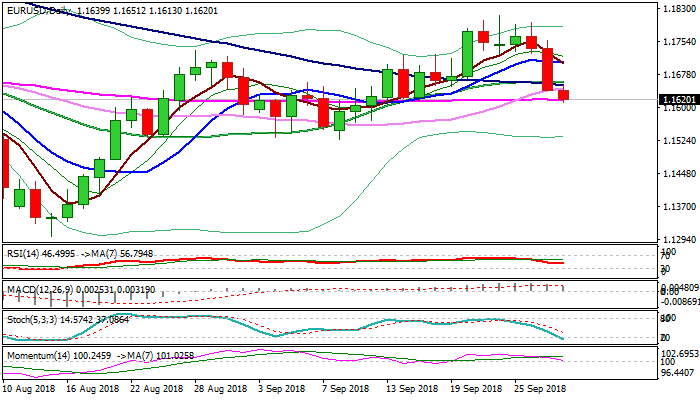

Threat of further weakness on weekly close below 30SMA

The Euro extended pullback from 1.1815 high through pivots at 1.1655/36 (rising 30SMA / Fibo 61.8% of 1.1526/1.1815 upleg) and cracked sideways-moving 55SMA (1.1617) which marks next key support.

The pair holds in red for the third straight day and made the biggest one-day fall since 14 June on Thursday, as downside pressure increased after release of upbeat US GDP data.

Daily techs are weakening, as MA’s are turning to bearish setup and south-heading momentum is approaching the border of negative territory, signaling further downside.

Weekly close below 30SMA would generate bearish signal and risk extension towards 1.1526 (10Sep trough).

Daily cloud twists late next week and could act as a magnet.

Meanwhile, bears may take a breather on profit-taking / oversold conditions, with broken 100SMA (1.1652) to ideally cap and guard upper pivots at 1.1700 zone (broken 10SMA / base of thick 4-hr cloud).

Res: 1.1652; 1.1670; 1.1692; 1.1704

Sup: 1.1613; 1.1594; 1.1565; 1.1534