Tight ranges ahead of BoJ US GDP data

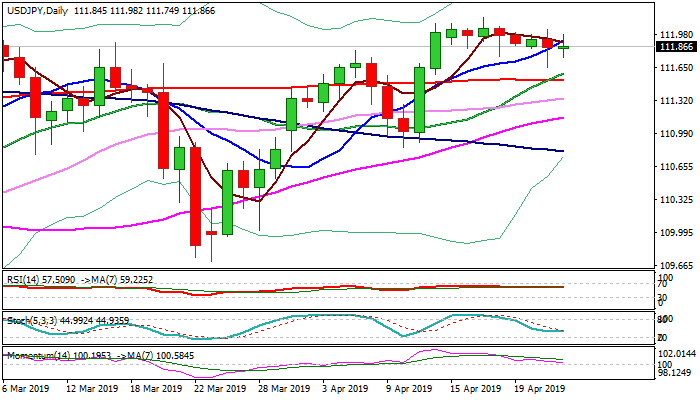

The pair holds within narrow range on Wednesday, as daily techs remain mixed and awaiting more signals from BoJ on Thursday and US GDP data on Friday.

Tuesday’s strong downside rejection at 111.65 (session low in Asia on Tuesday / Fibo 38.2% of 110.84/112.15 upleg) keep the downside protected for now, despite weakening momentum, as 20/200SMA’s golden cross strongly underpins.

Initial negative signal could be expected on break of 111.65 support, while confirmation of bearish scenario would require break and close below 200SMA (111.52).

Conversely, return above 112 barrier and violation of last week’s high at 112.15, is needed to generate bullish signal.

Res: 112.03; 112.15; 112.60; 113.00

Sup: 111.75; 111.65; 111.52; 111.34