US/China optimism keeps Aussie afloat despite repeated rejections at cloud base

The trades within narrow range on Friday, but the sentiment remains positive on US/China talks optimism, keeping the downside limited.

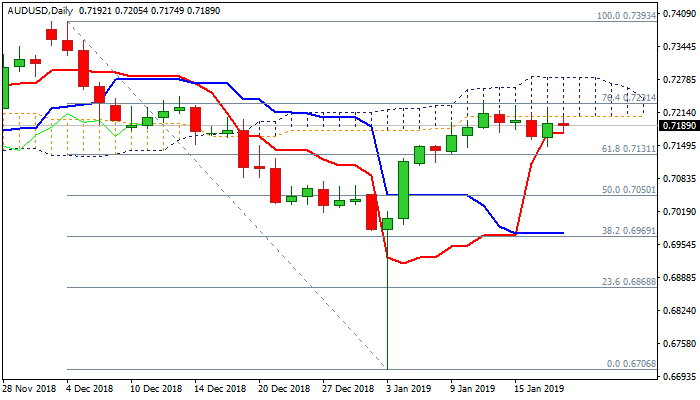

Thursday’s spike to 0.7221 following a news report was short-lived and the action again ended below daily cloud base, which marks significant obstacle (0.7207).

Daily techs remain in neutral mode and keep the pair in extended sideways trading, awaiting for a catalyst.

Eventual close above daily cloud base would generate initial bullish signal and expose targets at 0.7231 (Fibo 76.4% of 0.7393/0.6706) and 0.7282 (daily cloud top).

Bearish scenario would be initiated on close below 30 SMA (0.7139), with stronger negative signal expected on sustained break below 20SMA (0.7113).

Res: 0.7207; 0.7235; 0.7282; 0.7335

Sup: 0.7174; 0.7139; 0.7113; 0.7033