USD Index – bulls tighten grip ahead of release of key US economic data

The dollar index opened with gap higher and rose to 3 ½ week high on Monday, keeping firm tone at the start of the year.

Uncertainty over the US attack on Venezuela prompted migration into safety of dollar, but the greenback was also lifted by optimism that US economic data, due this week, (Manufacturing & Services PMIs / Dec labor data) would show better than expected values and add to expectations of resilience of the economy that would ease pressure on Fed to further ease its monetary policy.

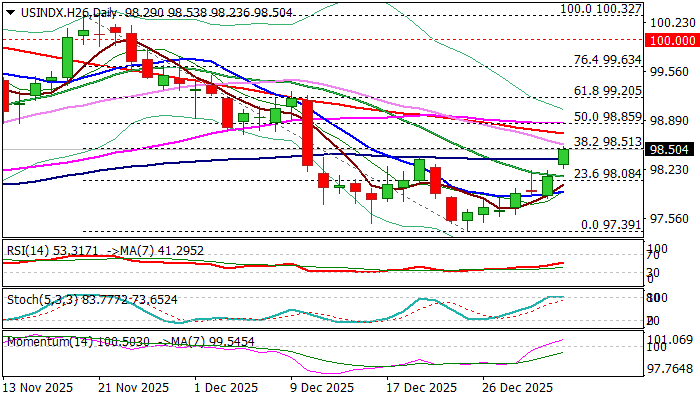

Technical picture on daily chart has improved on break above recent consolidation range top (98.40, reinforced by 100DMA) and attack at pivotal Fibo barrier at 98.41 (38.2% of 100.32/97.39 bear-leg), where bulls faced headwinds.

Sustained break here is needed to generate fresh bullish signal (reversal) and open way for stronger recovery, with extension through obstacles (200DMA at 98.71 and 50% retracement at 98.85) to confirm signal and expose targets at 99.20/30 (Fibo 61.8% / Dec 9 lower top).

Conversely, failure to break higher would keep the price within extended consolidation range, but biased higher while holding above pivotal support at 98.08 (base of thick daily cloud / broken Fibo 23.6% of 100.32/97.39 descend.

The larger picture shows the greenback holding within broader consolidation (95.82/100.32) after sharp fall in the first six months of 2025, when the index fell around 9.5%.

Res: 98.85; 99.00; 99.30; 99.63

Sup: 98.23; 98.08; 97.91; 97.58