USDJPY – bear-trap underpins but recovery still faces headwinds

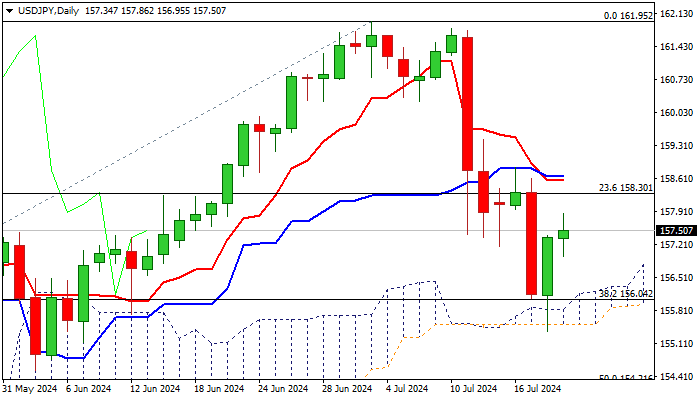

USDJPY remains constructive on Friday and attempts to further extend Thursday’s strong bounce, with recovery being supported by signals of a double bear-trap, following a false break below pivotal Fibo support at 156.04 and thin daily cloud (spanned between 155.83 and 155.50).

Rising and thickening daily cloud also underpins near-term action, however, headwinds are still to be expected, as structure on daily chart is still bearish.

Recovery needs to clear initial pivots at 157.73/88 (55DMA / Fibo 38.2% of 161.95/155.36) to reduce downside risk and open way for fresh acceleration towards next targets at 158.65/78 (falling 10DMA / 50% retracement).

Caution on repeated daily close under 55DMA.

Res: 157.73; 158.30; 158.86; 159.52

Sup: 156.91; 156.04; 155.36; 155.18