USDJPY-Bears hold grip and eye key support

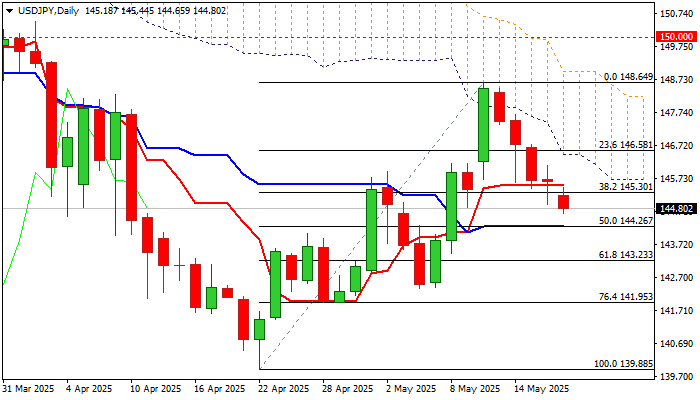

USDJPY continues to descend for the fifth consecutive day, after a double upside rejection and a bull-trap at 148.49 Fibo barrier (76.4% of 151.15/139.88) contributed to the change of direction.

Weaker dollar (which acted as a safe haven on trade uncertainty) following relief on US-China trade agreement and signal that BoJ may resume with tightening (which boosts demand for yen) were the main drivers.

Bears eye pivotal support at 144.26 (50% retracement of 139.88/148.64 recovery leg, reinforced by daily Kijun-sen and bull-trendline off 139.88), loss of which would further weaken near-term structure and risk deeper drop.

The action remains weighed by falling thick daily cloud, daily MA’s in predominantly bearish configuration and long upper shadow weekly candle of last week which points to growing offers and potential formation of reversal pattern on weekly chart.

However, bears are likely to face increased headwinds at 144.26 support that may keep the price in consolidation before attempts through 144.26 trigger.

Near-term action is expected to remain biased lower while below daily Tenkan-sen (145.51).

Res: 145.30; 145.51; 146.10; 146.58

Sup: 144.26; 143.84; 143.23; 142.38