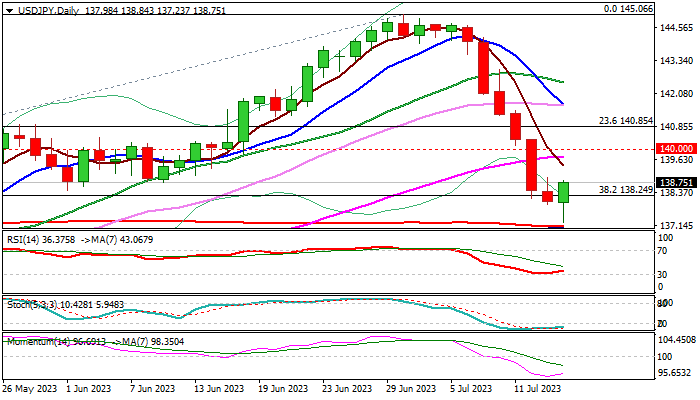

USDJPY bears lost traction on approach to 200DMA

The USDJPY bounces on Friday, registering significant gains for the first time in seven days and generating initial signal of correction.

Pullback from new 2023 high (145.06), which accelerated after dollar came under increased pressure on signals of nearing end of Fed’s tightening cycle and retraced slightly over 50% of 129.64/145.06 bull-leg, faced strong headwinds on approach to converged 200/100DMA’s (137.08/00 respectively).

Deeply oversold conditions on daily chart and profit-taking at the end of the week after steep fall (down nearly 3.5% for the week) contributed to fresh strength.

Friday’s action is shaping into a hammer candlestick, which would generate initial reversal signal, though with close above the top of daily cloud (138.44) required to validate the signal and open way for stronger recovery.

Fresh bulls eye initial Fibo resistance at 139.08 (23.6% of 145.06/137.23) but will need to extend above psychological 140 barrier to confirm reversal signal on daily chart.

On the other hand, the pair is on track for big weekly loss, which is going to weigh on fresh recovery attempts.

Res: 138.24; 138.95; 139.71; 140.00

Sup: 137.08; 136.14; 135.78; 135.00