USDJPY – bulls hold grip and pressure key barriers ahead of US inflation data

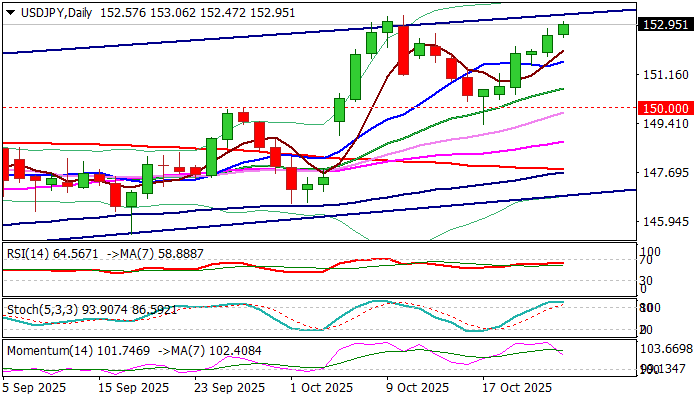

USDJPY – fresh bull-leg that emerged from last week’s correction low (149.37) extends into sixth straight day and cracks psychological 153.00 barrier on Friday.

The pair keeps firm tone as dollar benefits from the difference between Fed / BoJ interest rates, with more dovish stance expected from Japan’s new PM, to partially offset wide expectations of Fed rate cut on Oct 29 policy meeting.

Elevated US inflation also contributes to scenario while markets await release of delayed US CPI report today.

Hotter than expected September numbers would further support the greenback.

Bulls eye key barriers at 153.27/33 (post-Japan election high / upper boundary of larger bull channel) break of which to generate stronger bullish signal and unmask next target at 154.39 (Fibo 76.4% of 158.87/139.88).

Technical studies on daily chart are mixed as MA’s are in full bullish setup, but positive momentum is fading and stochastic is strongly overbought, with bullish signal seen on formation of bullish engulfing pattern on weekly chart, contributing to overall positive picture.

Initial support lays at 152.35, followed by 151.60 (rising 10DMA) and 150.70 (20DMA / weekly cloud top).

Res: 153.33; 154.00; 154.39; 154.80

Sup: 152.35; 151.60; 150.70; 150.00