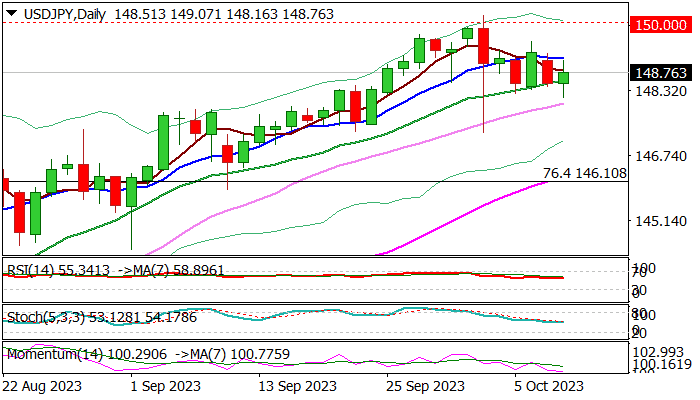

USDJPY – daily studies point to further gains after consolidation

USDJPY regained traction on Tuesday but remains within a congestion which extends into fourth consecutive day.

Pullback from 2023 peak (150.16) was repeatedly limited by rising 20DMA (currently at 148.58) which signals strong bids.

Larger uptrend from 127.22 (2023 low) remains intact and near-term action so far points to a shallow correction before bulls resume.

Initial bullish signal to be expected on close above 10DMA (149.12) which will open way for retest of pivotal barriers at 150.00 (psychological) and 150.16 (2023 high), guarding 2022 peak / multi-decade high (151.94).

Strong positive momentum on daily chart, Tenkan-sen/Kijun-sen in bullish setup and the action being underpinned by rising and thickening daily Ichimoku cloud, keep the upside in focus and point to further gains.

Caution on break below20DMA which would weaken near-term structure, but extension and close below Oct 3 spike low (147.29) is needed to sideline bulls and signal deeper correction.

Res: 149.12; 149.53; 150.00; 150.16

Sup: 148.00; 147.29; 146.10; 145.90