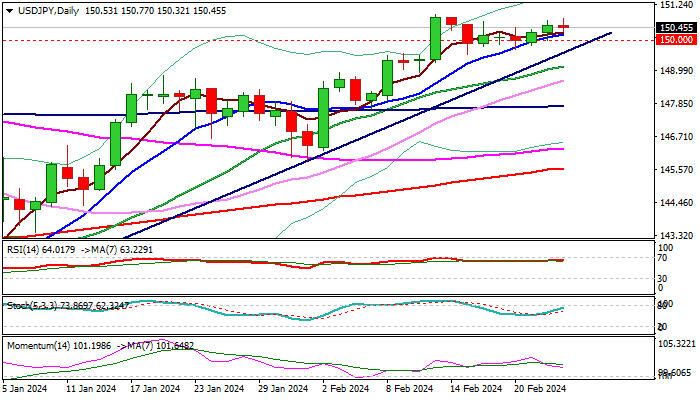

USDJPY – extended consolidation above trendline support to precede push towards key barriers

USDJPY edges lower on Friday as traders collect some profits ahead of the weekend but keeps overall bullish structure.

The pair is on track for another weekly gain and the second weekly close above 150 level, which will further boost positive sentiment and keep near-term focus on the upside.

Hawkish signals that the Fed is not in hurry to start cutting rates and overall positive US economic data, add to bullish outlook, along with weaker numbers from Japan’s economic indicators.

Markets shift focus to next week’s releases of Japan’s inflation report and US core PCE (Fed’s gauge for inflation) for fresh signals.

Meanwhile, prolonged consolidation may precede fresh push higher, with price action expected to hold above range floor / bull-trendline off 140.25 (149.68/52) and keep bulls intact.

Break of February’s peak at 150.88 to generate fresh bullish signal for extension towards key barriers at 151.90/94 (2023 2022 peaks) the highest in over three decades.

Res: 150.88; 151.00; 151.43; 151.90

Sup: 150.30; 150.00; 149.52; 149.11