USDJPY hit by latest tariff threats and hotter than expected Japan’s inflation

USDJPY fell further on Friday, driven by the latest comments from President Trump about 25% tariff on Apple phones that were manufactured abroad and Japan’s inflation above forecasts in April that may question BOJ’s intentions to proceed with policy tightening.

The pair is trading at two-week low in early US session on Friday, after the latest drop further weakened near-term structure.

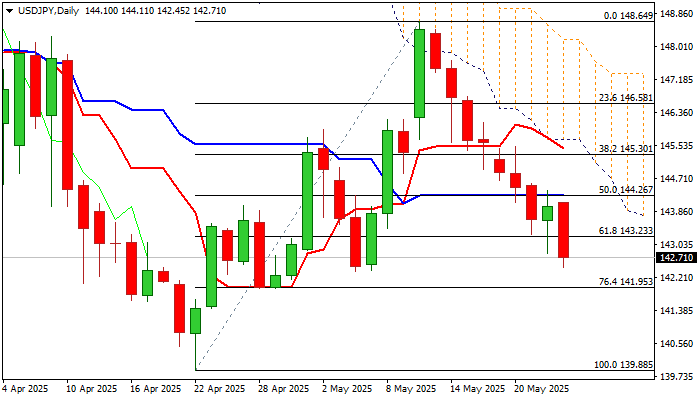

Important Fibo support at 143.23 (61.8% of 139.88/148.64 has been taken out, with weekly close below this level to add to negative stance (MA’s turned to full bearish setup, 14-d momentum remains below the centreline and falling and thickening daily cloud continues to weigh).

Completion of reversal pattern on weekly chart also contributes to bearish outlook.

Bears pressure target at 142.35 (May 6 trough) and eye a higher base at 141.95 (late Apr higher base / Fibo 76.4%) violation of which to unmask key supports at 140.00/139.88 (psychological / 2025 low).

Limited corrective action should be capped under broken daily Kijun-sen / 50% retracement (144.26).

Res: 143.23; 143.92; 144.26; 144.62

Sup: 142.35; 141.95; 141.42; 140.47