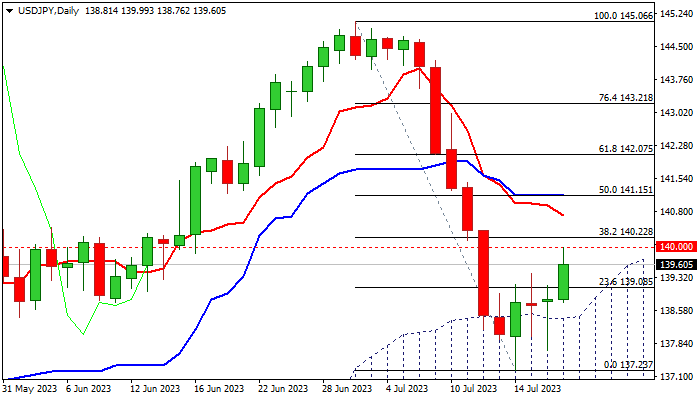

USDJPY – recovery regains traction but needs break through key barriers to signal continuation

USDJPY accelerated higher on Wednesday and dented psychological 140 barrier (reinforced by falling 10DMA), the lower boundary of pivotal resistance zone at 140.00/22 (140.22 is Fibo 38.2% of 145.06/137.23 bear-leg).

Fresh strength adds to reversal signals after recovery started last Friday, forming bullish engulfing pattern, but paused on Mon /Tue (double-Doji), though kept bullish bias as the price action remained above the top of ascending daily Ichimoku cloud.

Near-term structure improved, but technical studies on daily chart are still mixed (14-d momentum is deeply in negative territory, while RSI and stochastic are trending up and MA’s are in mixed configuration.

Firm break through 140.00/22 zone is needed to strengthen bulls and spark further recovery, with the action being underpinned by rising daily cloud.

However, headwinds at key resistances are strong and may obstruct recovery, with failure to break 140.00/22 pivots, to keep the downside vulnerable, but with limited risk while daily cloud contains dips.

Res: 140.00; 140.22; 140.71; 141.15

Sup: 139.40; 138.43; 137.68; 137.23