USDJPY – repeated upside rejections keep the downside at risk

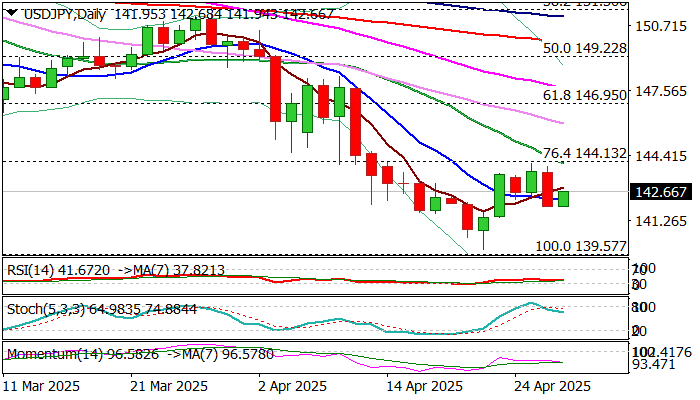

USDJPY edged higher on Tuesday morning after 1.1% drop on Monday which added pressure on the pair, following repeated upside rejection under double Fibo barriers at 144.13/21 (broken 76.4% of 139.57/158.87 / 38.2% of 151.20/139.88).

Strong negative momentum on daily chart and most of MA’s in bearish setup suggest that the downside remains vulnerable and high possibility of recovery stall in play as long as Fibo barriers cap.

Persisting risk of US tariffs is likely to keep the yen supported which would also contribute to scenario of limited or healthy correction before larger downtrend resumes.

Bank of Japan will deliver its policy decision on Thursday, with wide expectations to keep interest rates unchanged, as policymakers want to assess all scenarios caused by impact of tariffs before deciding to modify its monetary policy.

Markets also focus on US April labor report that will be released this week (JOLTS, ADP, NFP) which is expected to provide fresh signals.

Res: 144.13; 144.21; 144.55; 145.00

Sup: 141.94; 141.42; 140.47; 140.00