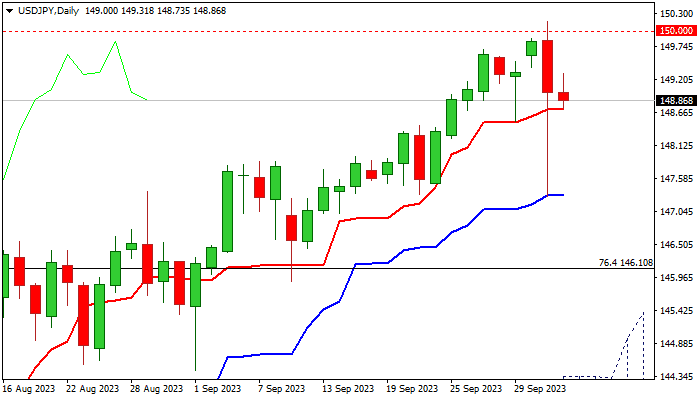

USDJPY stabilizes after Wednesday’s plunge, risk of more intervention remains high

USDJPY regained traction in early Wednesday’s trading and held above 149 mark, following turbulent action in the US session on Tuesday.

The pair cracked psychological 150 barrier after upbeat US JOLTS job openings report and hit the highest in nearly one year, ahead of sharp dip, which markets suspect to be sparked by intervention, as Japan’s authorities signaled several times that they will intervene to support falling currency.

Quick bounce from the spike low (147.29) where the drop was contained by rising daily Kijun-sen, left long-tailed daily candle, suggesting that the dollar remains bid.

Daily studies remain bullish and supportive for another attack at 150 barrier, break of which would unmask 2022 peak (151.94).

However, risk of further action by Japanese authorities keeps the downside vulnerable, with initial negative signal expected on break below daily Tenkan-sen (148.72) and confirmation on drop and close below daily Kijun-sen (147.29)

Res: 149.31; 149.70; 150.00; 151.04

Sup: 148.72; 148.29; 147.32; 146.10