USDTRY – short-lived lira’s rally after CBRT surprise

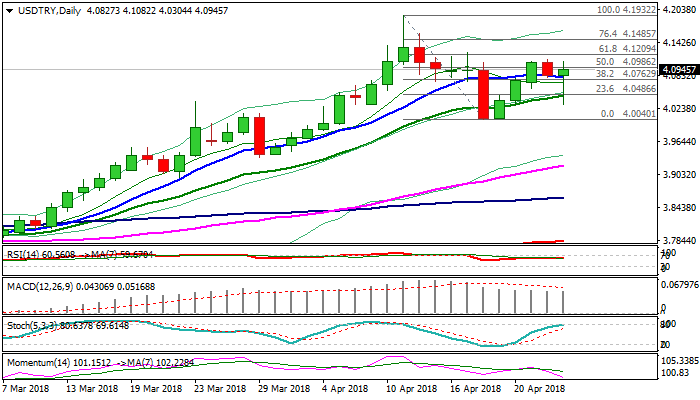

Turkish lira spiked to session high at 4.0304 (the highest since 20Apr) against US dollar after CBRT rate announcement today, but gains were so far short-lived, as the pair subsequently bounced above 4.10 barrier.

Turkish central bank surprised on stronger than expected late liquidity window rate hike (13.5% vs 13.25% f/c from 12.75%) but kept main interest rates unchanged.

Expectations for stronger lira’s rally after today’s CBRT decision (lira was sold when the CB hiked less than expected in Dec) are fading, as quick recovery pressures key near-term resistances at 4.11 zone (23/24 Apr highs).

With the dollar being strongly underpinned by US yields rising to new multi-year highs, little prospect for lira’s rally was left.

Fresh dollar longs above 4.00 remain favored scenario, which is supported by bullish daily techs and overall negative lira’s sentiment.

Bulls need firm break above 4.11 lower platform and 4.1209 (Fibo 61.8% of 4.1932/4.0040) to signal an end of corrective phase and shift focus towards new all-time high at 4.1932.

Conversely, bearish scenario needs break below 4.00 pivot to signal stronger correction.

Res: 4.1120; 4.1209; 4.1485; 4.1606

Sup: 4.0790; 4.0517; 4.0304; 4.0040