Vaccine optimism continues to support oil prices, but widening lockdowns weigh

WTI oil edged higher in early Monday, as rollout of Covid-19 vaccine boosts expectations for rise in global demand, while a tanker explosion in Saudi Arabia additionally lifted the price.

On the other side, widening lockdown in Germany and increase of the number of US oil rigs (the highest since January), could weigh on price action and limit gains.

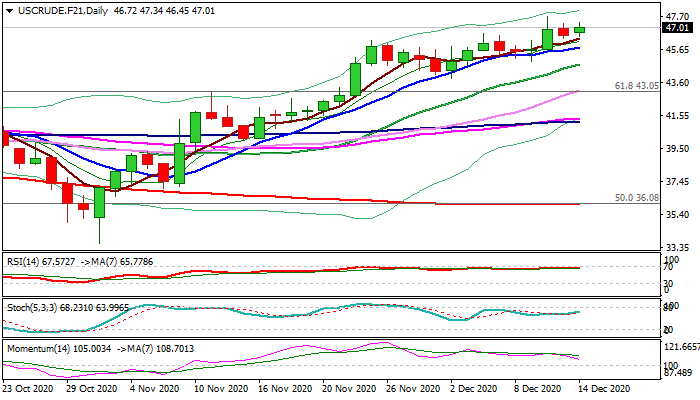

Technical studies on daily chart are mixed and lack clearer signals as moving averages remain in full bullish configuration, but bullish momentum is fading.

Near-term bias is expected to remain with bulls while the price holds above ascending 10DMA ($45.82), with possible deeper dips towards rising 20DMA ($44.74) to keep bulls unharmed.

Only break of 20DMA and $43.84 (Dec 2 trough) would weaken near-term structure and risk pullback.

Res: 47.34; 47.71; 48.47; 49.00

Sup: 46.34; 46.00; 45.82; 44.94