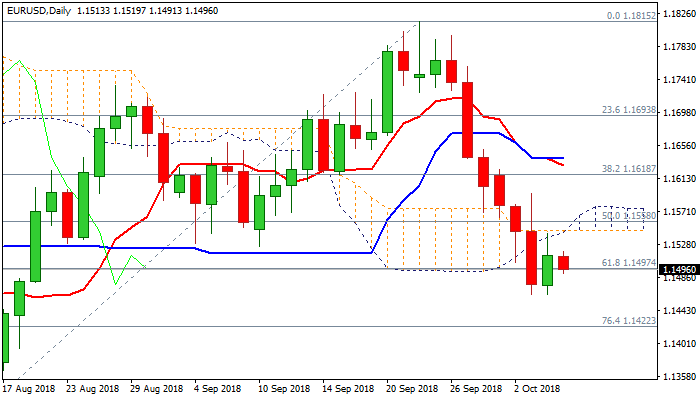

Weak tone after recovery was capped by daily cloud; NFP data eyed

The Euro stands at the back foot in early Friday’s trading, after Thursday’s recovery attempt was strongly rejected and capped by daily cloud base.

Strong bearish stance which lasts for over one week, prevented the pair from stronger bounce, despite today’s cloud twist which usually acts as a magnet.

Bearish daily techs favor further downside and look for strong bearish signal on weekly close below cracked pivot at 1.1497 (Fibo 61.8% of 1.1300/1.1815 ascend).

The pair is expected to stay in a quiet mode ahead of release of US jobs data, which are expected to be the key driver today.

Res: 1.1519; 1.1545; 1.1565; 1.1593

Sup: 1.1463; 1.1422; 1.1394; 1.1328