Weaker dollar eases downside risk; Brexit remains the top event for sterling

Cable holds positive tone in early European trading on Monday and pressures last Friday’s spike high at 1.2877, as fresh dollar’s weakness over rate hike concerns, keeps sterling bid and sidelines Brexit fears.

Political turmoil in the UK over Brexit talks keeps the pound volatile, as last week’s resignation of Brexit minister in the cabinet resulted in strong fall.

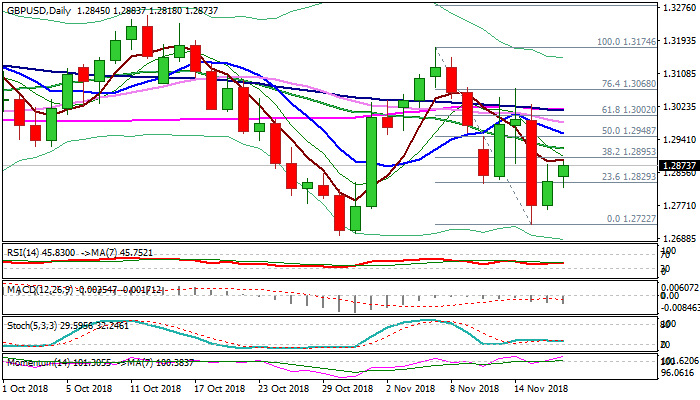

Daily techs are mixed, as MA’s remain in bearish setup; RSI and slow stochastic are flat, while momentum remains strong, lacking clearer direction signal.

Recovery needs break above pivotal barriers at 1.2895 (Fibo 38.2% of 1.3174/1.2722) and 1.2916 (falling 20SMA) to generate bullish signal for stronger recovery, while the downside would remain vulnerable if 20SMA limits u fresh bulls.

Focus remains at Brexit talks as pound’s recent key driver, with fresh news about the progress of negotiations, as well as tensions within PM May’s cabinet, expected to provide traders with fresh signals.

Res: 1.2883; 1.2895; 1.2916; 1.2948

Sup: 1.2818; 1.2805; 1.2760; 1.2722