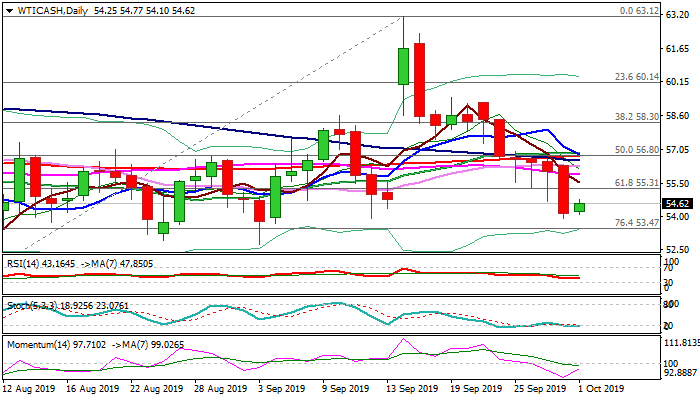

WTI is consolidating after 4% fall on Monday; outlook remains negative

WTI oil price is consolidating above new 2 ½ week low at $53.93, posted after nearly 4% fall on Monday.

Oil price came under increased pressure after strong upside rejection (16 Oct spike to $63.12 after attack on Saudi oil installation) and accelerated lower on renewed concerns about global economic slowdown, possible escalation of US/China trade conflict that would reduce global demand for oil, as well as much faster than expected restore of production of Saudi oil facilities, attacked two weeks ago.

Monday’s fall marked full retracement of $53.93/$63.12 jump and signals further weakness as sentiment remains weak.

Meanwhile, positioning is likely to precede fresh push lower, as daily techs are oversold and traders took some profits from strong fall in past seven days.

Daily Ichimoku cloud (spanned between $54.82 and $55.73) marks initial barrier that so far caps recovery attempts, with extended upticks expected stay below $56.00 (the lower boundary of strong resistance zone between $56.00 and $56.90, marked by a cluster of daily MA’s) to keep bears in play.

Break of $53.93 handle would open September’s low at $52.75 (3 Sep) and would risk extension towards key $50 support zone on stronger bearish acceleration.

Conversely, lift above $56.90 would sideline bears and allow for stronger correction.

Oil inventories reports are due later today and on Wednesday and eyed for fresh signals.

Res: 54.82; 55.73; 56.00; 56.90

Sup: 53.93; 53.47; 52.93; 52.75