WTI oil – brightening demand outlook continues to inflate the price

WTI oil price continues to trend higher and hit five-month high on Tuesday, probing above $85.00 barrier for the first time since late October.

The last bull-leg extends into fourth consecutive day, underpinned by brightening demand outlook on firmer than expected China’s and US economic data, as well as drop in OPEC oil production in February.

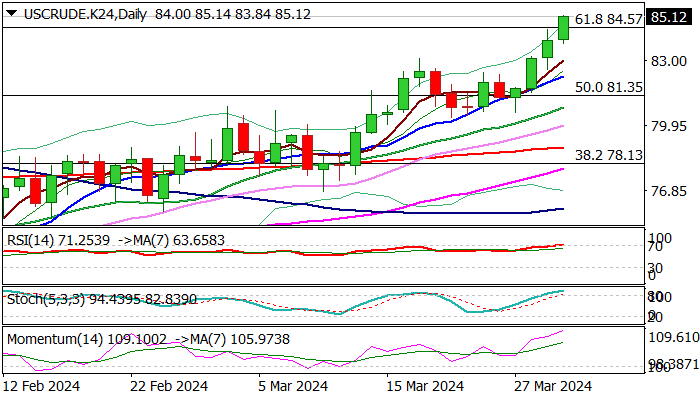

Fresh bullish signal is developing on daily chart after the price broke above pivotal Fibo barrier at $84.57 (61.8% retracement of $95.00/$67.70 downtrend), with close above this level to confirm signal and contribute to support from bullish daily technical studies.

Bulls eye immediate target at $85.87 (Oct 27 high), guarding $88.56 (Fibo 76.4%).

Former top ($8310) and rising 10DMA ($82.24) should contain corrective dips to offer better buying opportunities.

Res: 85.87; 87.00; 88.56; 90.00

Sup: 84.57; 83.58; 83.10; 82.24