WTI Oil – bulls eye $90 barrier, underpinned by tight supply outlook

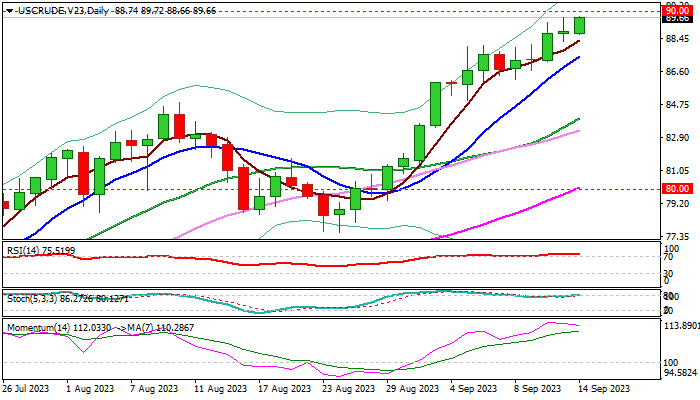

WTI oil keeps firm tone and hit new multi-month high on Thursday, approaching psychological $90 barrier.

Tighter global supply outlook on the recent decision of Saudi Arabia and Russia to extend production cut until the end of the year, keeps the price supported and offsetting concerns over weakening economic growth and rise in US crude inventories.

Bulls pressure $90 pivot, break of which would generate fresh bullish signal, in addition to violation of pivotal Fibo resistance at $89.06 (38.2% of $130.48/$63.45) and open way for extension towards $93.30/70 (Oct/Nov 2022 lower platform) and $96.07 (50% retracement).

Bullish daily studies underpin, however overbought conditions may produce headwinds at $90 barrier.

Dips should ideally find footstep above rising daily Tenkan-sen ($87.35) and extensions lower not to exceed $84.87 (former top of Aug) to keep larger bulls in play and offer better buying opportunities.

Res: 90.00; 92.64; 93.30; 93.72

Sup: 88.27; 87.35; 85.92; 84.87