WTI oil – bulls hold grip on favorable fundamentals but may take a breather for consolidation ahead of key barriers

WTI oil extends advance into eighth consecutive day and hit the highest in over two weeks on Wednesday, after OPEC’s forecasts for a robust demand and decline in US fuel stocks added to growing concerns, driven by geopolitical factors.

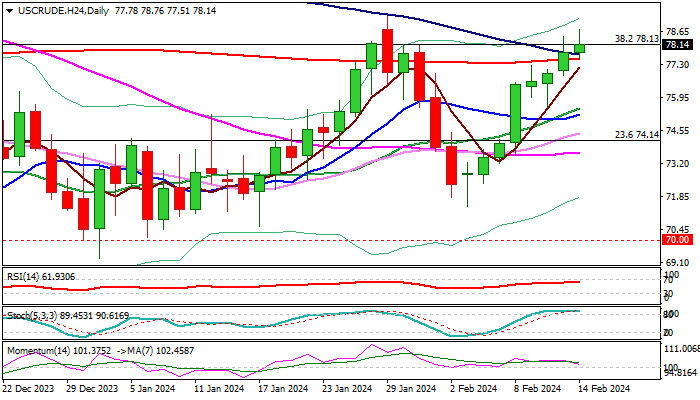

Break above converged 100/200DMA’s ($77.51/70) and Fibo 38.2% of $95.00/$67.70 ($78.13) generated fresh bullish signal, with close above these levels needed to confirm and open way for test of pivotal barriers at $79.27/$80.00 (Jan 29 top / psychological).

The price emerged above daily cloud and rising Tenkan-sen is diverging from Kijun-sen, confirming bullish configuration of daily technical studies however, overbought conditions may produce increased headwinds and put bulls on hold for consolidation.

Dips should ideally find ground above daily cloud top ($76.78) to keep larger bullish structure intact.

Res: 78.80; 79.27; 79.57; 80.00

Sup: 77.51; 76.78; 75.50; 75.24