WTI oil collapses to 8-month low on growing recession fears

WTI oil price tumbled on Friday, hitting the lowest levels since early January, as dollar spiked to new 20-year high and growing demand fears as sharp increase of interest rates is driving major economies into recession.

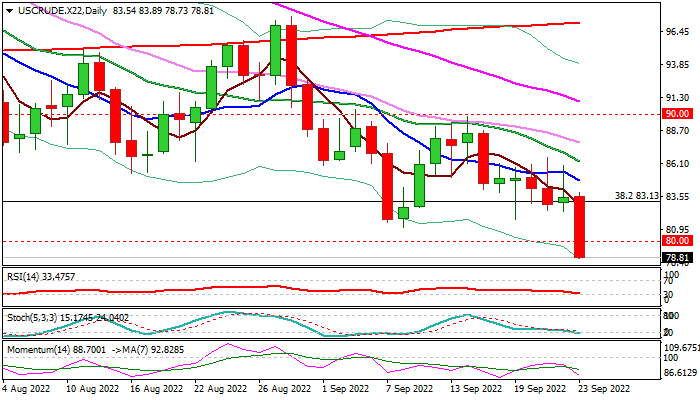

The contract was down over 5.5% for the day until now, with losses likely to extend as bears accelerated through key technical supports.

Break of former low at $81.17 (Sep 8) signaled an end of corrective phase, with violation of psychological $80 support, adding to negative signals.

WTI is on track for the fourth straight weekly drop, with likely weekly close below $83.13 (broken Fibo 38.2% of 2020/2022 $6.57/$130.48 recovery) to generate strong bearish signal, which will be reinforced by close below $80 level.

Bears eye next pivotal supports at $78.48/$77.35 (Fibo 76.4% of $62.42/$130.48 bull-leg / 100WMA), violation of which would risk drop towards $72.34 (200WMA).

Res: 80.00; 81.17; 81.73; 83.13

Sup: 78.48; 77.34; 74.25; 72.34