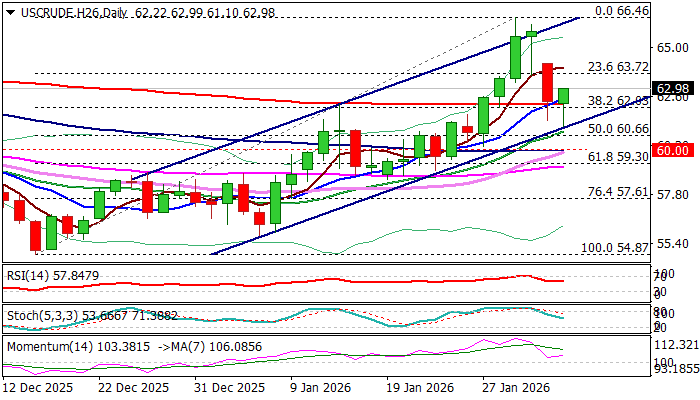

WTI OIL – double failure at key support zone signals that pullback from new multi-month high might be over

WTI oil extended pullback from new multi-month high ($66.46) in early Tuesday’s trading, following gap-lower opening at the start of the week and over 4% drop on Monday which marks the biggest daily loss since Nov 11.

Signals of de-escalation in US-Iran tensions eased supply fears and prompted strong selling, along with firmer dollar.

Although Tuesday’s fresh extension lower pointed to rising risk of deeper correction of $54.87/$66.46 recovery leg, some technical signals will be still required to verify the action.

A double attempt through key supports at $62.21/03 (200DMA / Fibo 38.2% of $54.87/$66.46) has so far been repeatedly rejected which develops signal of healthy correction before larger bulls regain control.

The notion is supported by a double bear-trap under 200DMA, multiple MA bull-crosses and positive momentum studies.

Repeated close above 200DMA to generate initial bullish signal, with extension above $64.00 zone needed to boost the structure for attempts to fill Monday’s gap and open way for retest of key barriers at $66.40/46 (tops of Sep 26 / Jan 29) and confirm reversal.

Res: 63.00; 63.72; 64.00; 64.66

Sup: 62.50; 52.21; 62.03; 61.10