WTI OIL – fresh fall of oil price signals an end of corrective phase

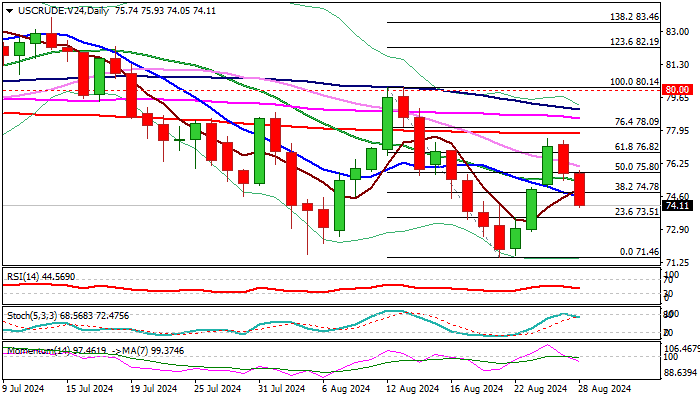

Oil price declines for the second straight day after recent three-day strong recovery rally was repeatedly rejected just under 200DMA ($77.80).

Subsequent weakness generated reversal signal following a break below pivotal support at $74.51 (50% retracement of $71.46 / $77.57 recovery leg, reinforced by 10DMA).

Daily studies weakened (MA’s are back to full bearish setup and 14-d momentum dipped to negative territory) adding to downside risk.

Quick change in the sentiment from increasingly bullish (on Libya supply concerns and geopolitical tensions) to negative, was mainly influenced by growing demand worries and elevated risk of broader economic slowdown.

This signals high volatility and points to fundamentals as currently key market drivers, which can quickly reverse direction, despite encouraging technical picture.

Res: 74.51; 75.24; 75.93; 76.13

Sup: 73.79; 72.90; 72.19; 71.46