WTI OIL holds in red on easing concerns about Iran and surprise build in crude inventories; EIA report in focus today

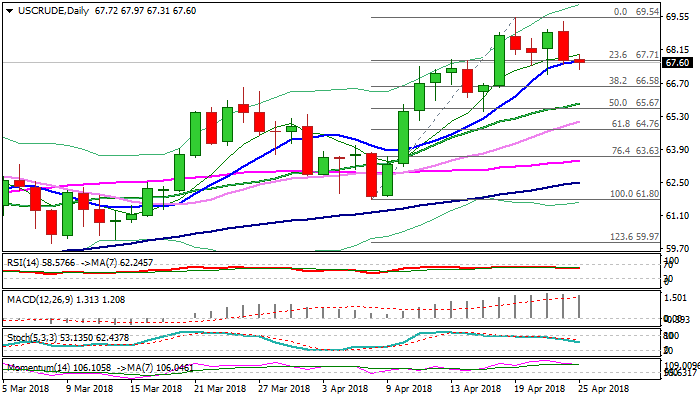

WTI oil stands at the back foot on Wednesday and breaks below 10SMA ($67.64) which contained downside attempts in past two days.

Fresh weakness emerged after repeated rejections under $70 target ($69.54 and $36) as oil price lost support from concerns about new sanctions against Iran.

In addition, API report, released on Tuesday, showed surprise build of US crude stocks (1.09 million barrels vs 2 million barrels draw forecasted), putting oil under increased pressure.

Focus turns towards EIA crude oil inventories report, due today and forecasted for 2.04 million barrels draw.

Another surprise build in oil stocks could spark fresh weakness for test of immediate support at $67.12 (Tuesday’s spike low) and pivotal support at $66.58 (Fibo 38.2% of $61.80/$69.54 upleg), loss of which would generate bearish signal for deeper correction.

Conversely, EIA report in line or above expectations would boost oil price and neutralize immediate downside risk.

Today’s close against 10SMA would be one of key indicators about near-term direction.

Close above would shift near-term focus higher and expose again $70 target, while close below 10 SMA would indicate further easing.

Res: 67.97; 68.44; 69.00; 69.36

Sup: 67.31; 67.12; 66.58; 65.86