WTI Oil – larger bears likely to pause after a steep fall

WTI oil traded within a narrow range on Friday as steep fall of past six days started to run out of steam.

Oil came under increased pressure from recent decision of OPEC+ to further increase production, darkened economic outlook after US import tariffs were implemented, with the latest signals of potential meeting of US President Trump and Russian President Putin for peace talk, adding to weakened sentiment.

The WTI contract is on track for the weekly loss of over 4% (the biggest weekly fall since the third week of June), following previous week’s strong upside rejection at psychological $100 barrier and formation of a bull-trap.

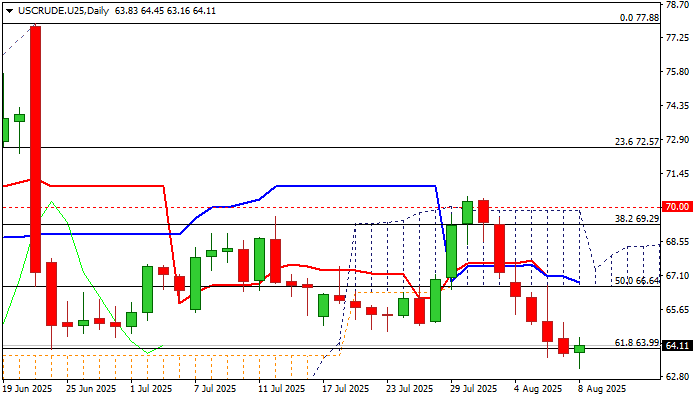

Fresh bears cracked pivotal $64.00 support (Fibo 61.8% retracement of $55.40/$77.88 rally / the low of June 22 massive fall) but need to register sustained break here to confirm negative signal of bearish continuation of the downtrend from $77.88 (June 22 peak) and expose next targets at $60.71 (Fibo 76.4%) and $60.00 (psychological).

Meanwhile, bears are likely to take a breather on oversold daily studies and end-of-the-week profit-taking.

Broken 100DMA ($64.70) offers immediate resistance, with potential extended upticks to be capped under $66.50 zone (converged 10/20/55 DMA’s / daily cloud base) to keep larger bears in play.

However, market participants remain very cautious about the peace talks and its outcome, as talks failure scenario remains on the table and in such case oil price would be strongly inflated by strong change in sentiment as Trump’s secondary sanctions on buyers of Russian energy will be likely activated and spark fresh turbulence in oil markets.

Res: 64.88; 65.96; 66.50; 66.83

Sup: 63.16; 62.18; 61.24; 60.71